Dupont formula roi

In the 1920s the. Rasio leverage keuangan Total aset Total ekuitas.

Using Dupont Formula For Company Roa And Roe Analysis Daniel

EBIT Net income Interest Tax.

. Operating efficiency which is. In addition to indicating the return on investment ROI for shareholders DuPont analysis also factors in three important performance elements. The return on equity dis-aggregate performance into three components.

Alright lets go over the items under the five-stage DuPont decomposition. DuPont analysis ROE example. By splitting ROE return on equity into three parts companies.

Return on Equity ROE Tax Burden Asset Turnover Financial. Pertama perusahaan dapat melakukannya. The Three Component Dupont Formula This formula observes that ROE can be broken out into three key contributing factors ROE or EarningsEquity EarningsSales x.

The formula for calculating each input is listed on the side while the ROE formula can be seen in the highlighted cells. Rumus yang diperluas ini mempertimbangkan tiga faktor terpisah yang mendorong laba atas ekuitas. DuPont explosives salesman Donaldson Brown invented the formula in.

Formule permettant de calculer le ROI Si lon suit le modèle Du Pont on obtient le ROI de votre entreprise en multipliant le taux de la marge dexploitation par le taux de rotation. DuPont analysis is based on analysis of Return on Equity ROE Return on Investment ROI. Under DuPont analysis return on equity is equal to the profit margin multiplied by asset turnover multiplied by financial leverage.

DuPont Model ROE DuPont analysis is an expression which breaks ROE Return On Equity into three parts. Tax burden measures the effect of taxes. DuPont Identity or DuPont Model Formula Profit Margin Net income Net Sales Total Asset Turnover Net Sales Total Assets Financial Leverage Total Assets Total equity Return on.

Asset use efficiency 3. DuPont analysis also known as the DuPont identity DuPont equation DuPont framework DuPont model or the DuPont method is an expression which breaks ROE return on equity into three parts. The formula is as follows.

Rumus di atas menunjukkan kepada kita dua cara untuk meningkatkan ROE. ROE DuPont formula Net profit Revenue Revenue Total assets Total assets Equity Net profit margin Asset Turnover Financial leverage. Return on Equity Net Profit Margin x Total Asset Turnover x Equity Multiplier Written by CFI Team Updated February 19 2022 What is DuPont Analysis.

Rumus analisis DuPont adalah perluasan dari rumus ROE sederhana. Finally the investor uses the figures from each of their previous calculations to calculate each companys return on equity using the DuPont. The name comes from the DuPont company that began using this formula in the 1920s.

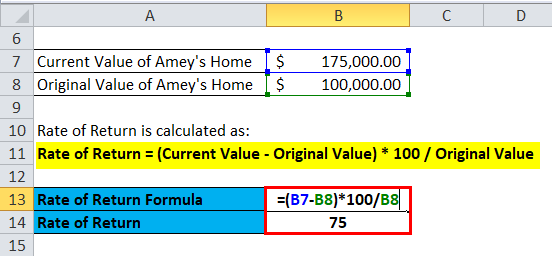

Rate Of Return Formula Calculator Excel Template

50 Strategy And Management Models Powerpoint Templates Part 2 Slidesalad

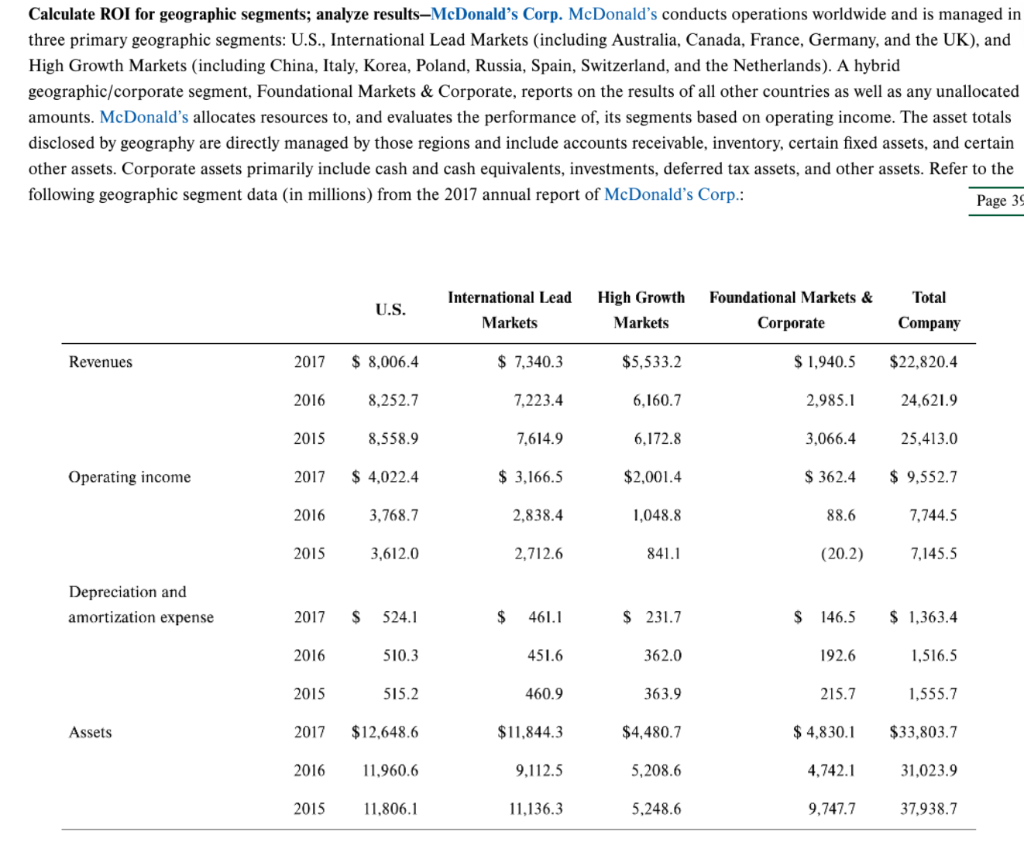

Solved Calculate Roi For Geographic Segments Analyze Chegg Com

The Dupont Roi Model Investing Inventory Sale Back To Work

Dupont Analysis Adapted By P V Viswanath With Permission Ppt Download

Using Dupont Formula For Company Roa And Roe Analysis Daniel

Dupont Analysis Formula Breakdown And Calculator

Dupont Analysis Adapted By P V Viswanath With Permission Ppt Download

Dupont Analysis Formula Breakdown And Calculator

Dupont Analysis Formula Breakdown And Calculator

Relevance Lost Summary In Question Format Long Version

Dupont Analysis Youtube

Using Dupont Formula For Company Roa And Roe Analysis Daniel

Dupont Analysis Adapted By P V Viswanath With Permission Ppt Download

Dupont Analysis Formula Breakdown And Calculator

Dupont Analysis Formula Breakdown And Calculator

Dupont Analysis Formula Breakdown And Calculator